- HOME

- Corporate Information

- Philosophy / Strategy

- Value Creation Model

Value Creation Model

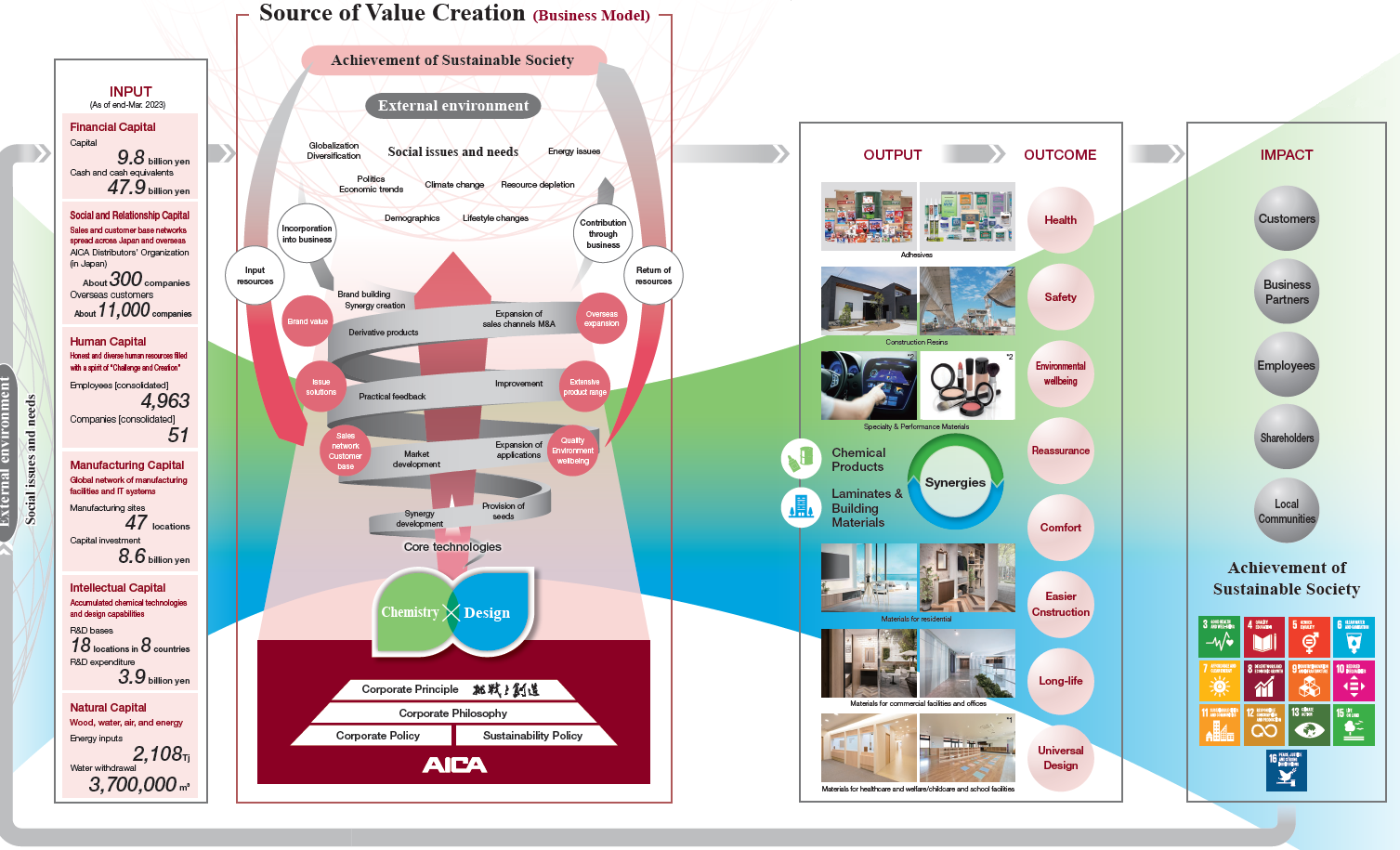

AICA’s Value Creation Model

The source of AICA’s Value Creation Model lies in our development capabilities that use core technologies based on chemistry and design, our domestic and overseas sales networks and customer bases, our capabilities in helping to solve social issues developed through dialog with stakeholders, our range of high-quality products and brand value generated from those capabilities, excellent human capital, and a healthy financial base. We resolve social issues through our business activities by creating synergies between the Chemical Products and Laminates & Building Materials Businesses, and continuing the cycle of improving and expanding these strengths. Guided by a philosophy of kyosei*, that places importance on dialog with stakeholders, AICA creates new value and contributes to society through continuous innovation.

- Please refer here for the meaning of kyosei

- Shion Kindergarten Annex + Shion School Children’s Club Design: Kozue Hotta, Goyoukiki ※2:Example of usage

AICA’s Strengths Supporting Value Creation

AICA’s strengths lie in our extensive product range that leverages the advantages in chemistry and design, as well as a solid customer base which supports that product range, overseas business bases, brand value, excellent human capital, the trust of society backed by high quality and environmental wellbeing, and a healthy financial base. We will improve our corporate sustainability by emphasizing dialog with stakeholders and continuing to enhance these strengths.

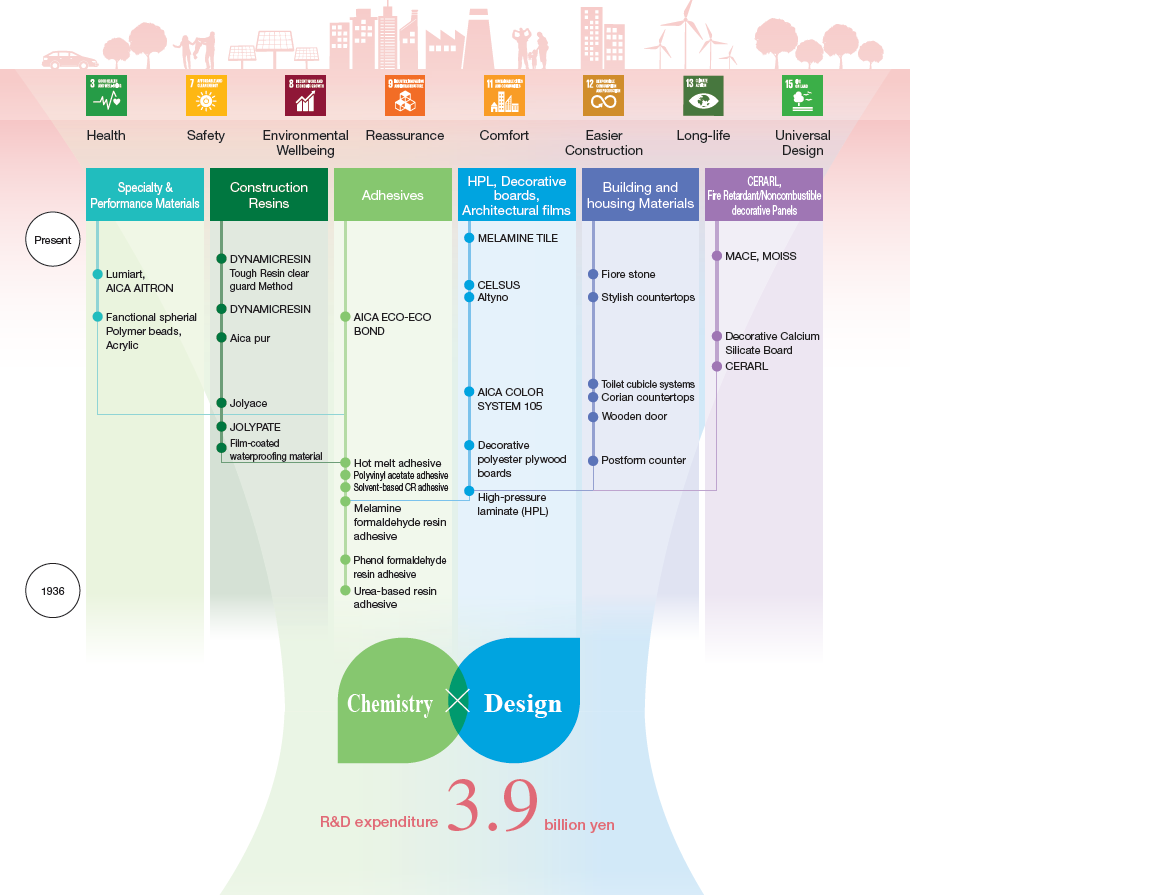

Helping solve social issues with the power of chemistry and design

AICA’s most distinctive feature is our ability to respond to social issues and needs by delivering unique products through synergies between performance created by our core technologies: synthetic chemistry technologies and resin design technologies, and design in the broader sense, including ease of use as well as beauty of color and pattern.

Related Capital

- Human Capital

- Natural Capital

- Social and Relationship Capital

- Manufacturing Capital

- Intellectual Capital

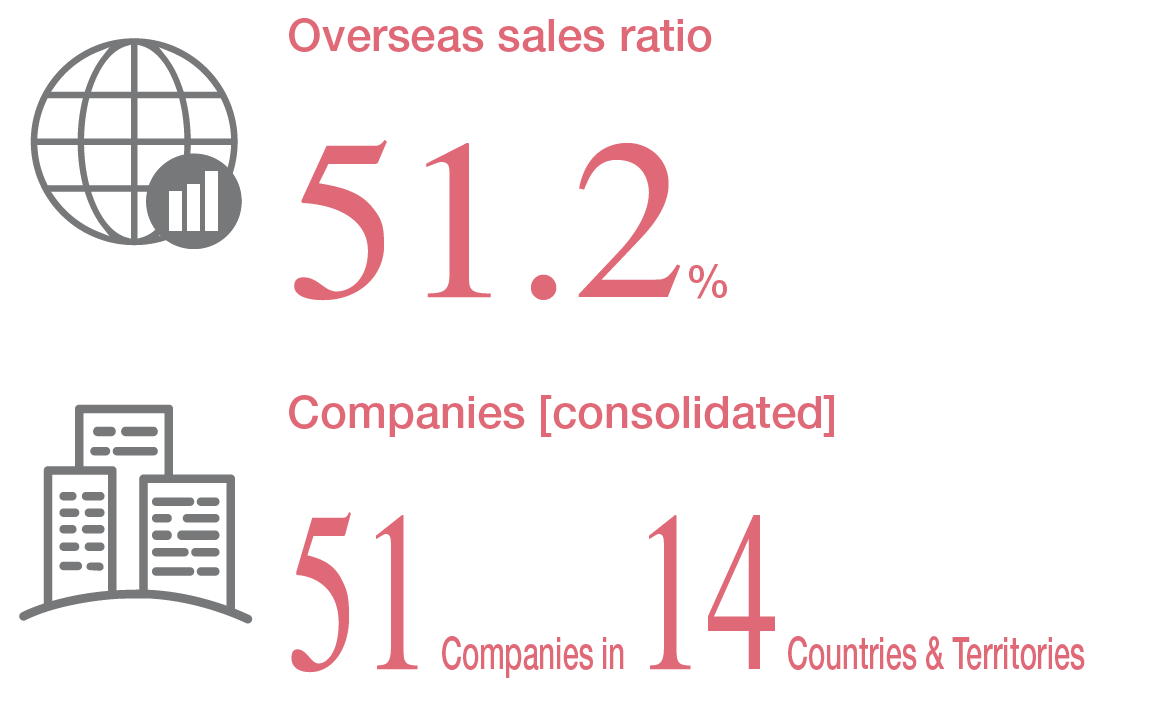

Overseas expansion

In recent years, we have continued to grow by expanding our business domains and networks, with a focus on growth markets in Asia. Through aggressive M&A, we acquire superbly qualified human resources, production bases and sales channels to enhance our competitiveness.

Related Capital

- Human Capital

- Social and Relationship Capital

- Manufacturing Capital

- Natural Capital

Customer base

With its deep understanding of AICA products, the AICA Distributors’ Organization supports the distribution of our HPL, which boast the top share of the Japanese market. We have also established a solid customer base with more than 10,000 companies overseas.

Related Capital

- Social and Relationship Capital

- Human Capital

Brand value

The name “AICA” is synonymous with HPL, as is the name “JOLYPATE” with wall coating materials, and no cosmetic product developer is unfamiliar with the name “GANZPEARL.” These are some of our many strong-performing brands that boast high market shares in their respective industries.

Related Capital

- Intellectual Capital

- Human Capital

- Social and Relationship Capital

Quality/Environmental wellbeing

Constantly receptive of customer feedback, we provide high-quality, environmentally-friendly products. We also proactively address environmental issues such as climate change and contribute to the creation of a sustainable society.

Related Capital

- Human Capital

- Social and Relationship Capital

- Intellectual Capital

- Natural Capital

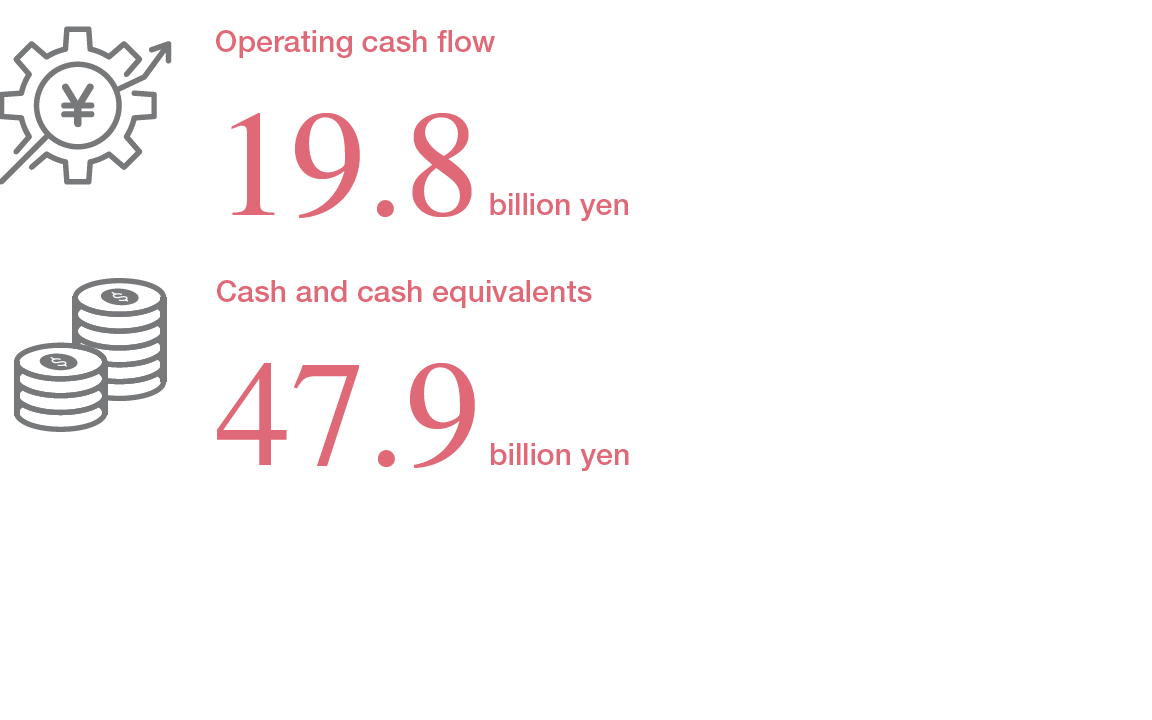

Healthy financial base

We have established a healthy financial base, with a high equity ratio supported by stable operating cash flow. This leads to a virtuous cycle that enables active growth investment and return of profits.

Related Capital

- Financial Capital

- Manufacturing Capital

(FY2022 Results)