- HOME

- Corporate Information

- Philosophy / Strategy

- 10 Years Vision & Medium-Term Business Plan

10 Years Vision & Medium-Term Business Plan

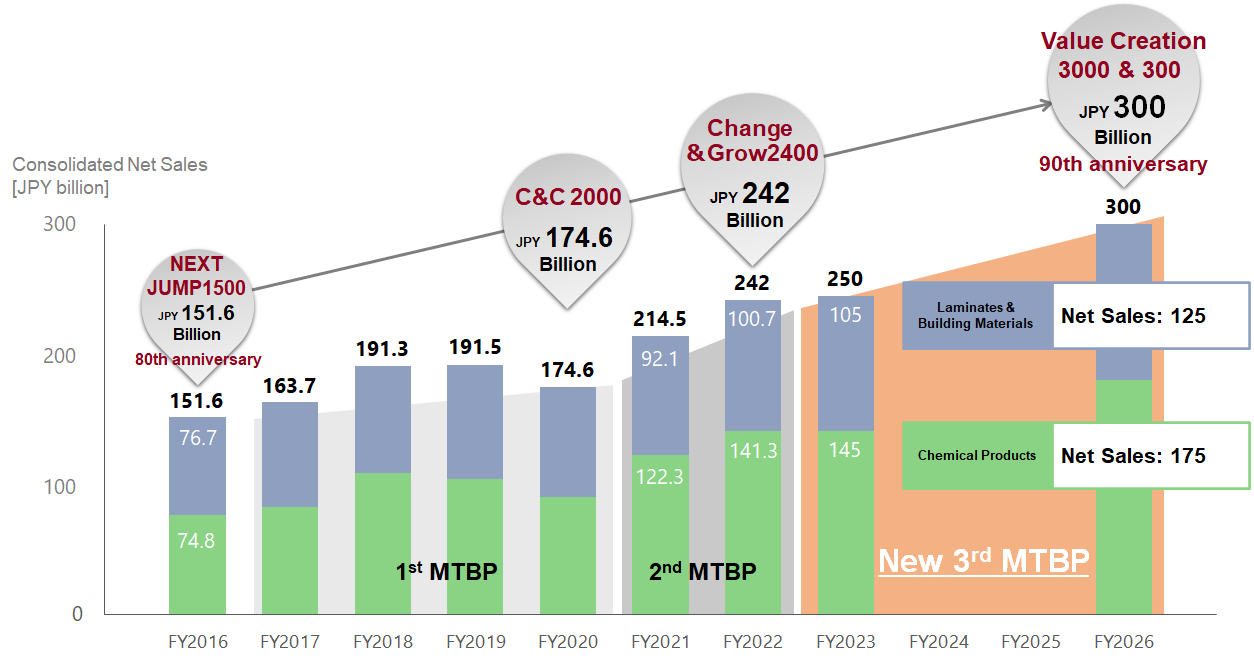

Aica’s 10 years vision (FY2016‐FY2026)

Financial targets in 10 years

| 2017/4 | 2027/3 | ||

|---|---|---|---|

| Consolidated Sales | JPY 151.6 Billion | JPY 300 Billion | |

| Ordinary Profit | JPY 18.3 Billion | JPY 30 Billion | |

| ROE | 9.9% | > 10% | |

| Overseas sales Ratio | 30.8% | > 45% |

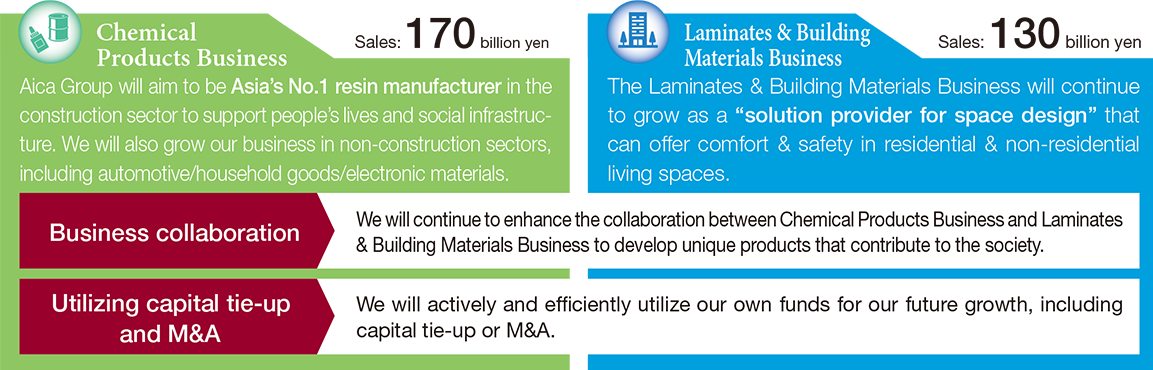

The future vision at FY2026

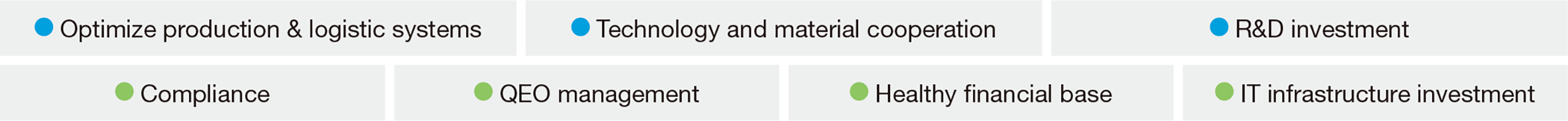

Group Collaboration & Operation Base Enhancement

Human resource development

Responsibility to stakeholders

The MTBP "Value Creation 3000 & 300"(FY2023 - FY2026)

The MTBP “Value Creation 3000 & 300” is the 3rd phase in AICA's 10 years vision.

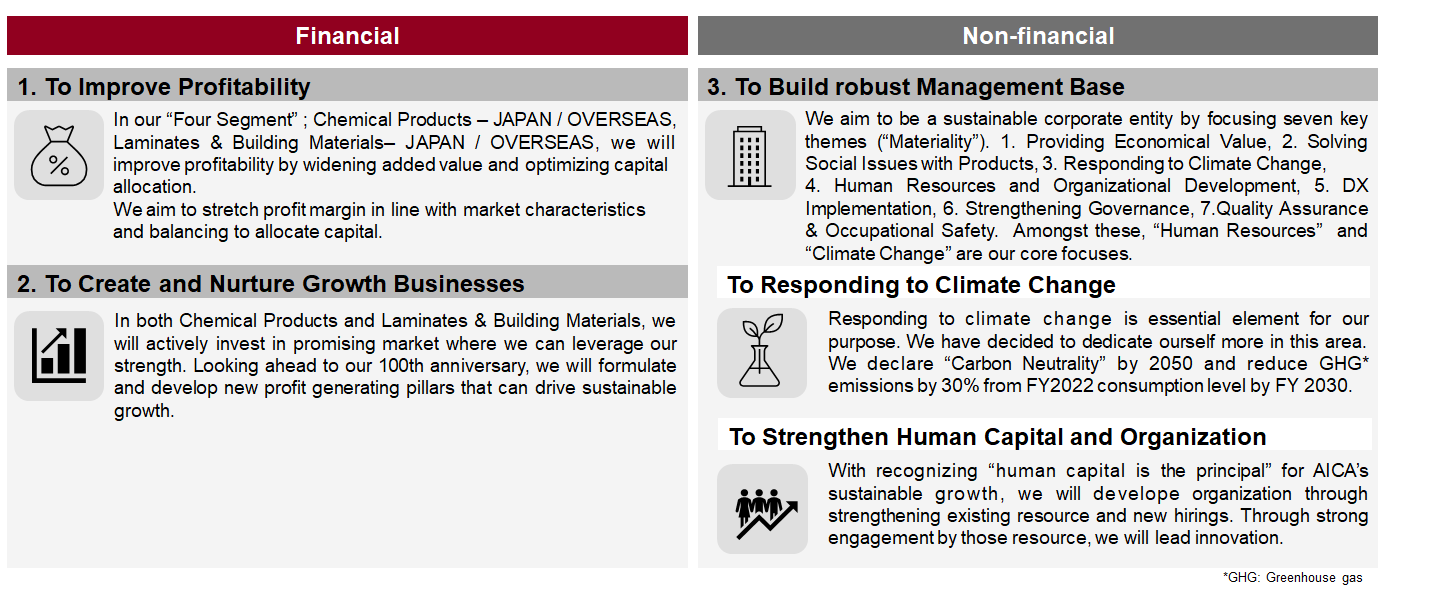

Fundamental Policies

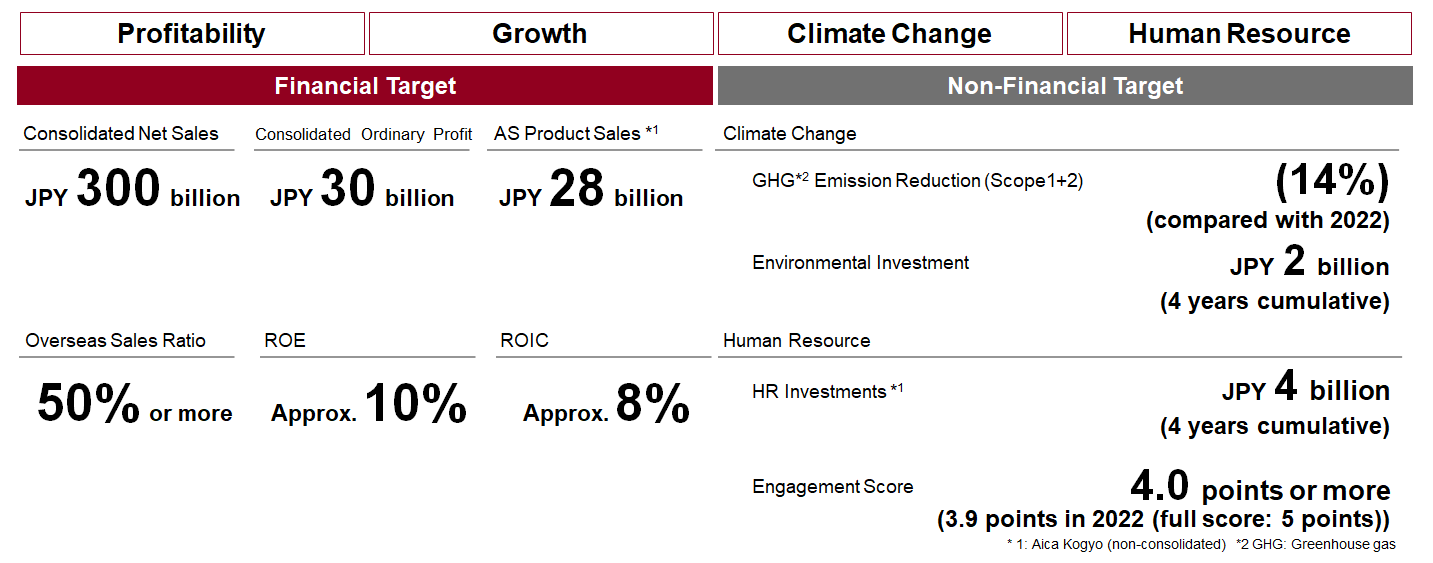

Managerial KPI

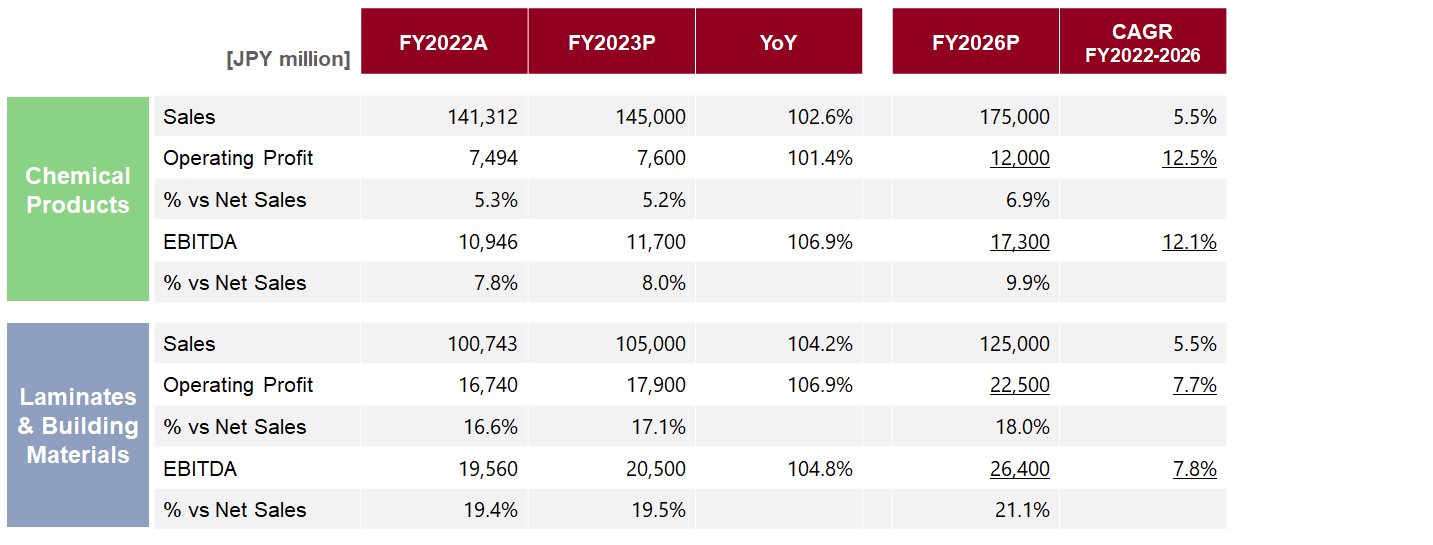

Financial Target by Segment

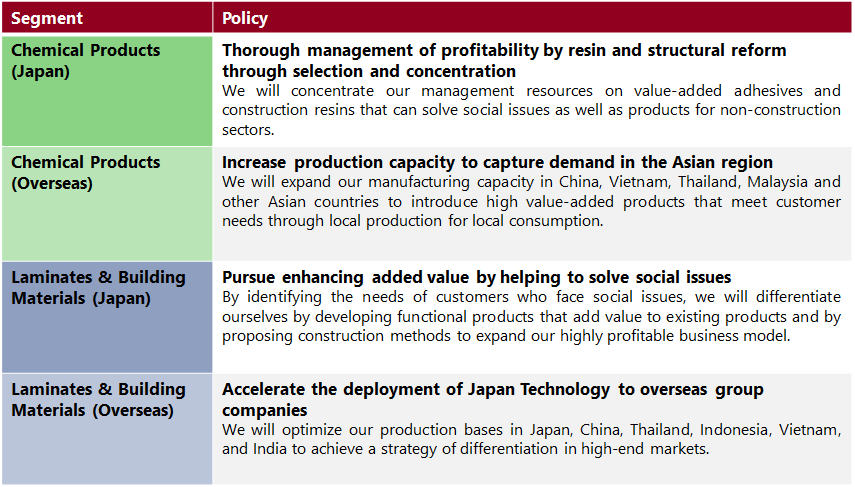

Priority Strategic Policy of the MTBP

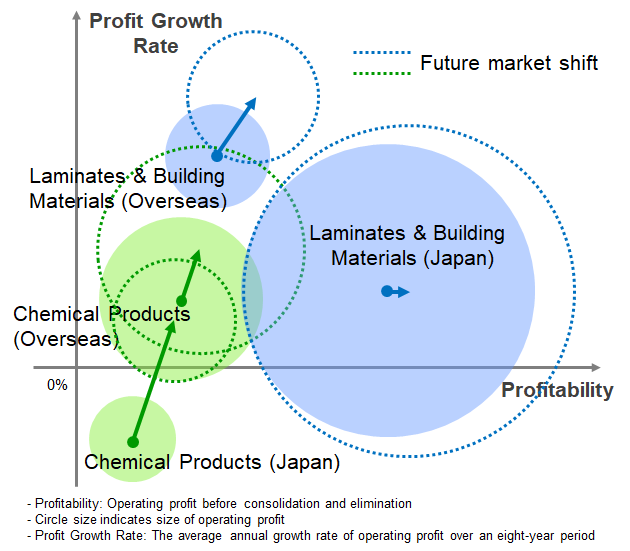

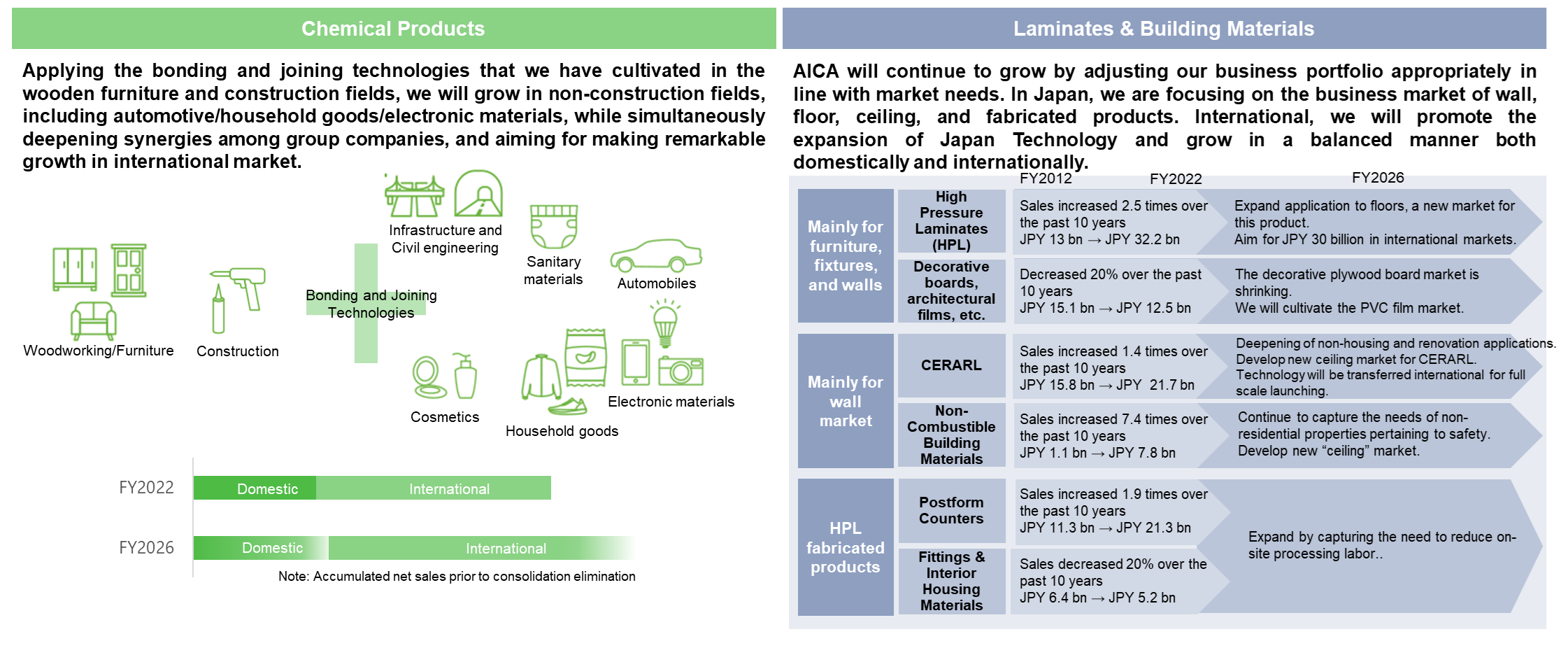

(1) Profitability Improvement

AICA will focus on improving profitability in the domestic Chemical Products business and overseas business for both Laminates & Building Materials and Chemical Products. For Laminates & Building Materials business in Japan, we expand the scale while maintaining our current position.

(2) Creation and Expansion of Growth Businesses

By focusing on solving social issues and entering/cultivating untapped markets, we will create growth businesses in a well-balanced manner both in Japan and overseas for both Chemical Products and Laminates & Building Materials to build a foundation for sustainable growth.

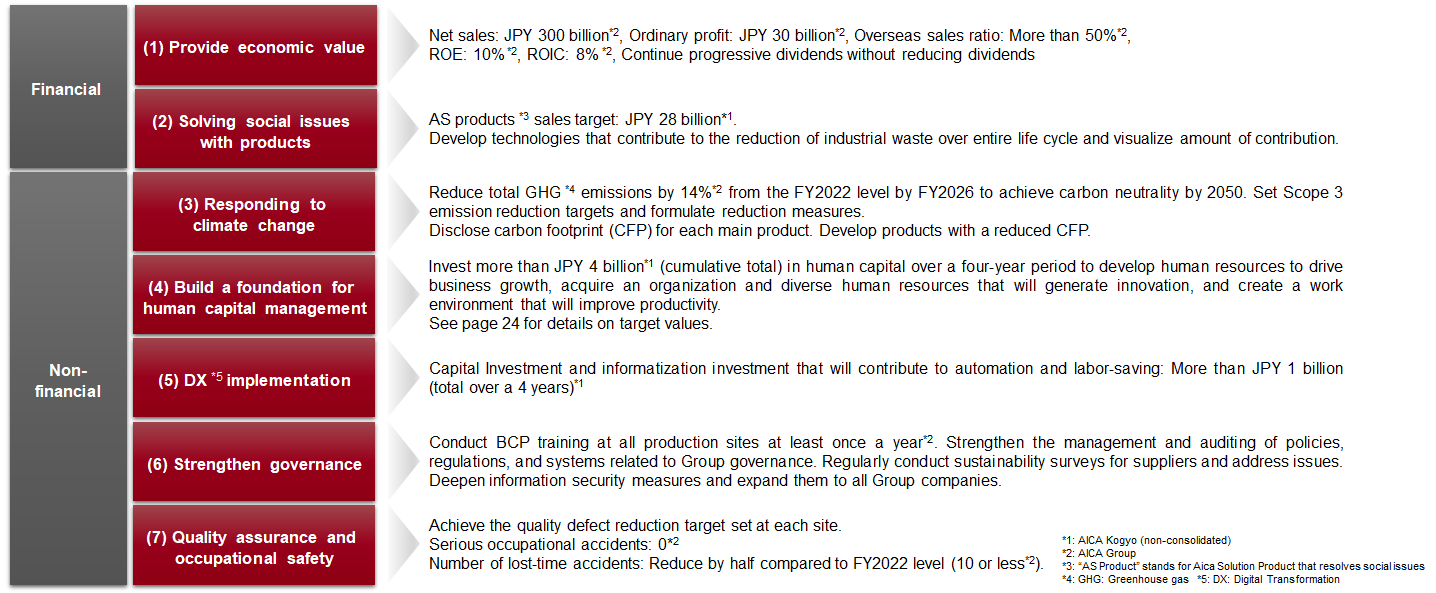

(3) Creation of a Sound Business Infrastructure

Addressing the seven material issues passed on from the previous Medium-Term Business Plan, we will focus on addressing “climate change” and “building a foundation for human capital management”.

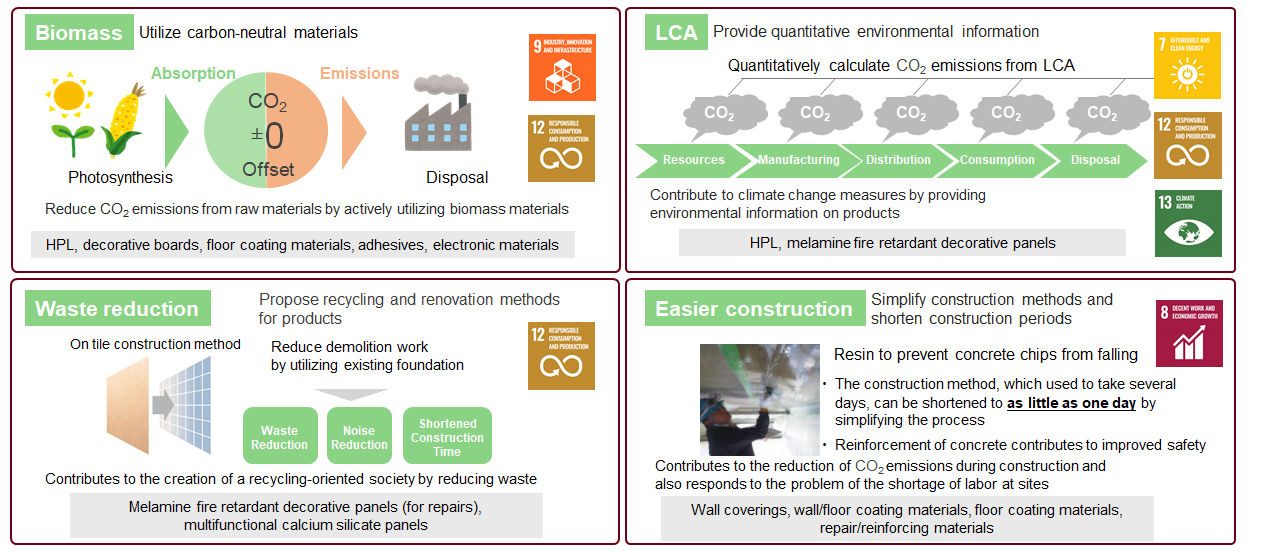

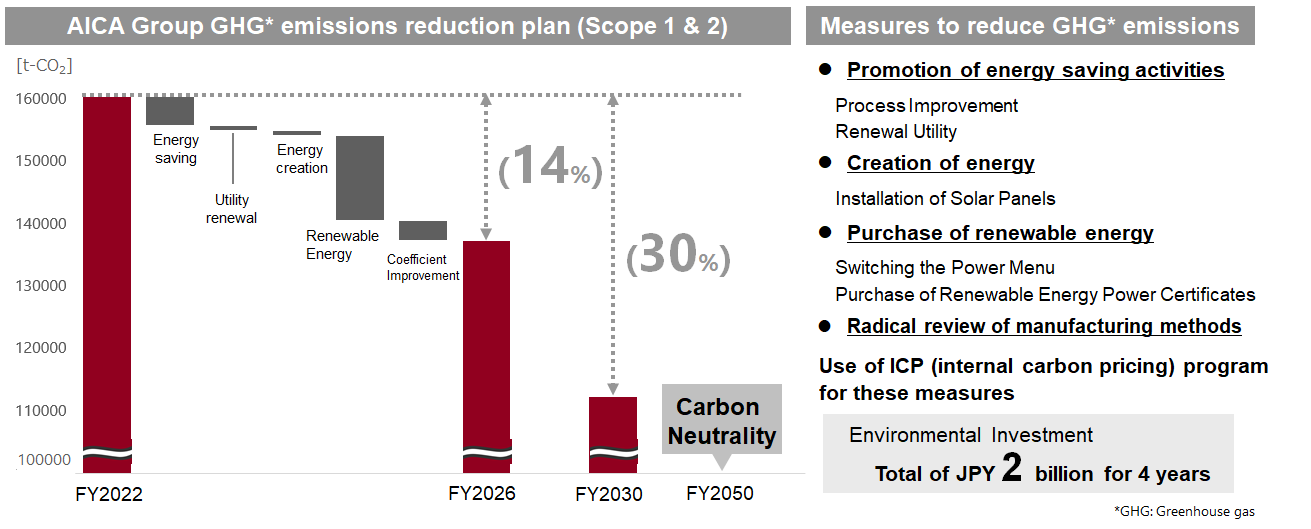

Climate Change Response Policy

(1) Responding to Climate Change Through Our Products

Based on AICA's resin synthesis technology and material utilization technology, we will develop and expand sales of products that respond to the climate change issues.

This will allow us to transform into a corporate group that achieves sustainable growth even in a rapidly changing world.

(2) GHG Emission Reduction Targets

Reduce GHG* emissions by 14% in FY2026 and by 30% in FY2030 (Scope 1 & 2, compared to FY2022) with the aim of achieving carbon neutrality in FY2050.

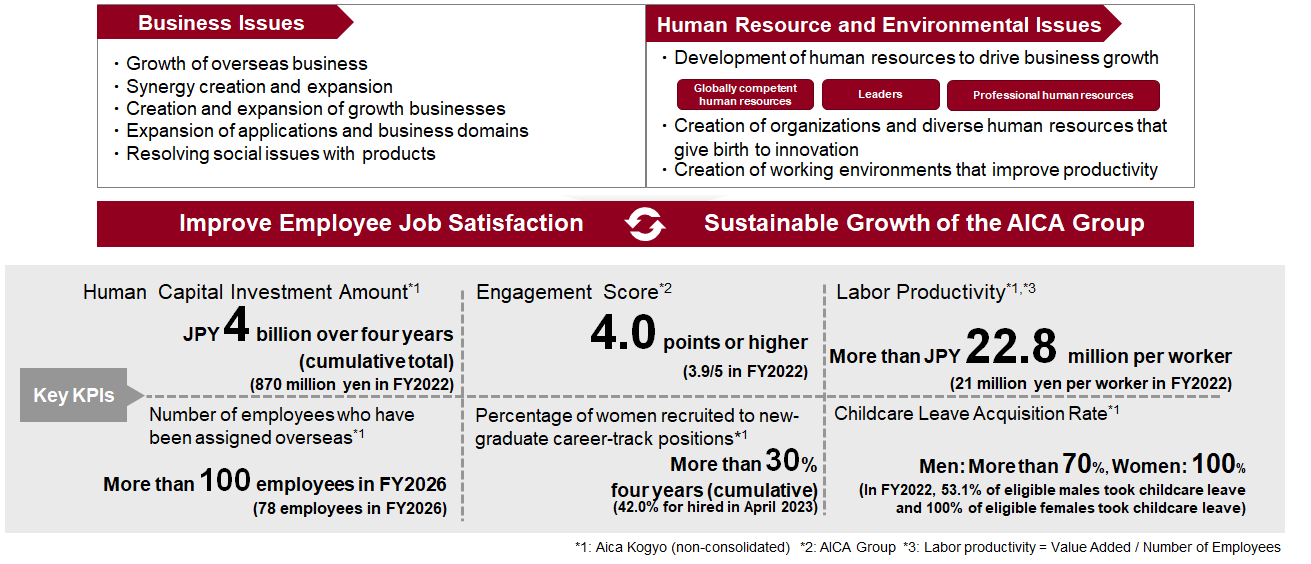

Human Capital Investment Policy

With the aim of maximizing the value of human capital, AICA will proceed human resource development and environmental improvement in line with business issues to achieve sustainable growth.

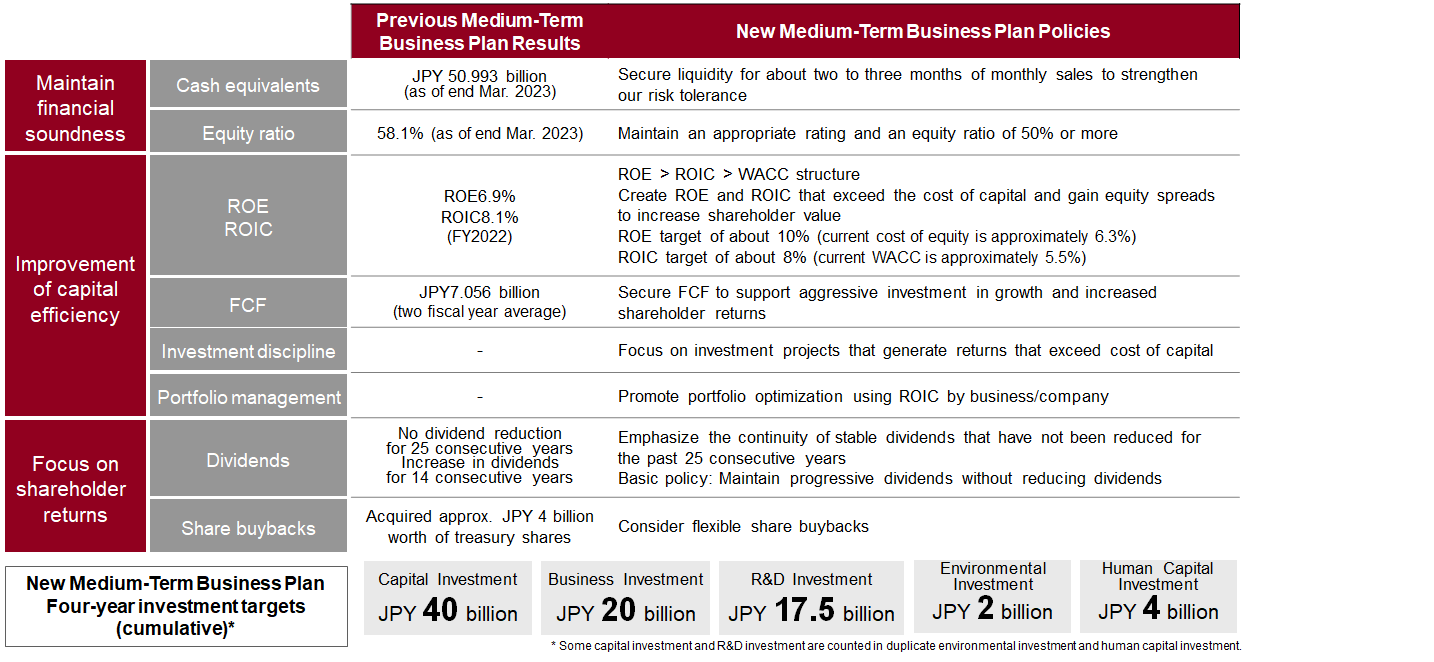

Capital Policy

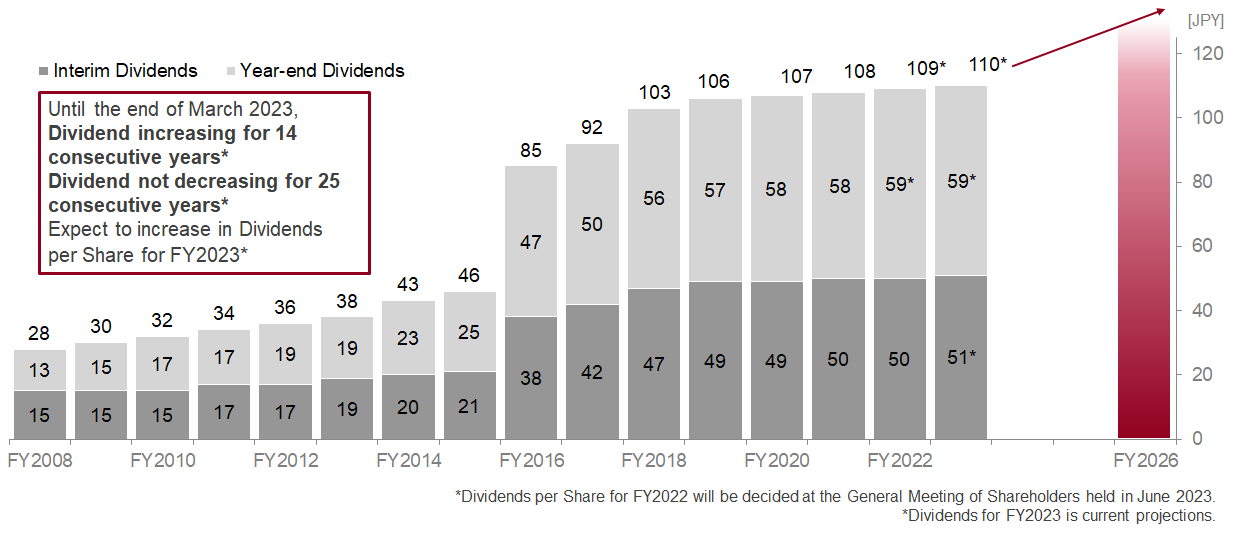

Dividend Policy

In order to return profits to shareholders and to realize sustainable corporate growth, our fundamental policy is to pay dividends after comprehensively considering the consolidated results for each term, the dividend payout ratio, and internal reserves. Under "Value Creation 3000 & 300“, our new Medium-term Business Plan, we continue our basic policy of a progressive dividend, avoiding a dividend reduction, and we will also consider flexible share buybacks.